Print-on-demand (POD) businesses have gained significant popularity over recent years, particularly on e-commerce platforms such as Etsy. These businesses allow entrepreneurs to create custom products, ranging from trendy t-shirts, stylish backpacks, and personalized phone cases to mugs, without having to invest in inventory upfront.

However, payment collection can be a challenging aspect of running a POD business. In this article, we’ll explore the current state of payment collection in print-on-demand businesses, top trends and examples, and predictions for the future of payment collection.

How Does Payment Collection in Print-on-Demand Businesses Look Now

To simplify the payment collection process, many POD businesses use e-commerce platforms such as Shopify, WooCommerce, or Etsy. These can integrate with popular payment gateways and handle much of the payment collection process automatically.

All of these eCommerce platforms offer a range of payment options, including credit card payments, PayPal, Stripe, and Apple Pay, making it easy for customers to pay for their orders. Additionally, they often provide tools to manage taxes, shipping fees, and other costs associated with running a POD business.

However, payment collection can become a complicated process if the business operates in multiple countries or if it offers customizations that impact the price of the product. In these cases, the payment gateway may require additional information or charge extra fees. This can be frustrating for both the business owner and the customer.

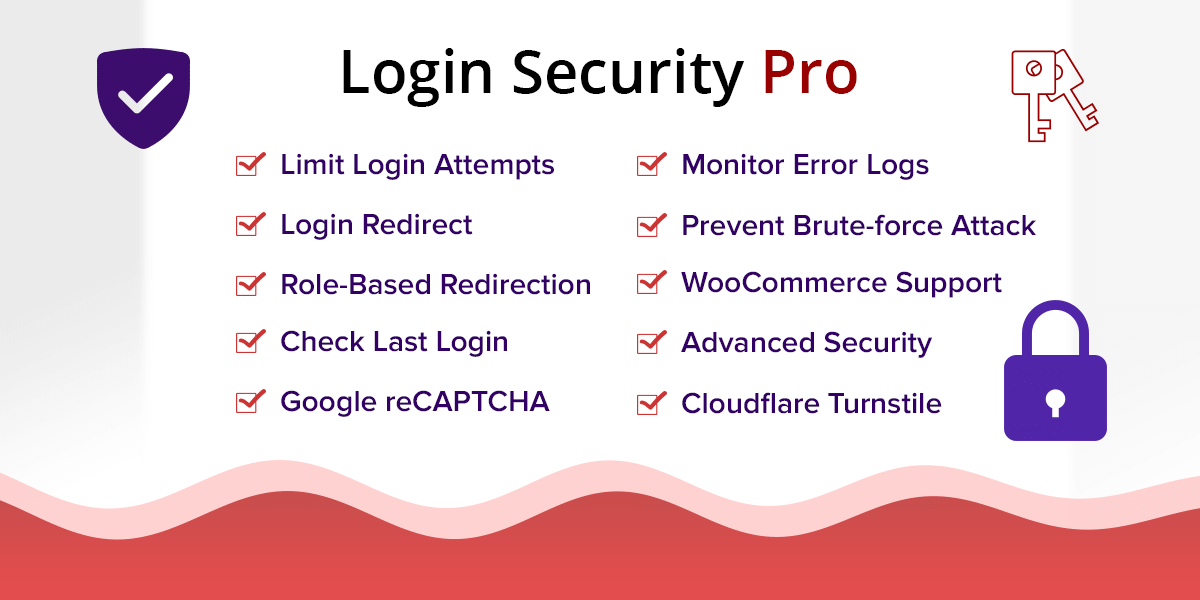

In addition, the best print-on-demand companies still need to make sure that their payment collection process is secure. It should also meet industry standards for protecting customer data. This includes implementing SSL encryption, PCI compliance, and fraud prevention measures to protect against chargebacks and other fraudulent activities.

Overall, the current payment collection process in print-on-demand businesses relies heavily on payment gateways and e-commerce platforms. It makes the process easier for both the business owner and the customer. Although there are still other challenges associated with collecting payments, these platforms have made it easier for POD merchants to sell their products and grow their businesses online.

Top Trends and Examples

The world of print-on-demand is constantly evolving, with new trends and innovations emerging all the time, particularly when it comes to how payments are collected.

From t-shirt printing businesses to custom phone cases brands, the payment system is an integral part. A customer-friendly and efficient payment collection mechanism ensures smooth transactions across the varied offerings.

Here, we’ll explore some top trends and examples in the payment collection for POD businesses, from integration with e-commerce platforms and mobile payment options to subscription models.

Automatic payment and fulfillment

Print-on-demand businesses have adopted automatic payment and fulfillment processes. Here, orders are automatically processed and fulfilled without any manual intervention.

Leading print-on-demand platform Printify, for example, already offers an automatic payment and fulfillment process. Business owners can connect a credit or debit card and add a balance from a PayPal account or from a Payoneer account. Once the balance is added, Printify automatically charges the account for each order as it is fulfilled. It makes the payment collection process a breeze for business owners.

Integration with e-commerce platforms

Many POD businesses are integrating their storefronts with e-commerce platforms, such as Shopify or WooCommerce. These integrations streamline the payment collection process and provide additional features, such as abandoned cart recovery and customer analytics.

For instance, most top print-on-demand platforms seamlessly integrate with Shopify, Etsy, WooCommerce, BigCommerce, and others. These integrations allow business owners to easily create and sell custom products on their own website, online marketplace, or online store. The payments are processed directly through the respective sales platform.

Mobile payment options

As more customers shop on their mobile devices, print-on-demand businesses are offering mobile payment options, such as Apple Pay or Google Wallet. These payment methods allow customers to complete their transactions quickly and securely.

For example, Ecwid, a popular e-commerce platform, allows customers to pay using their mobile wallets, including Google Pay and Apple Pay. This feature not only makes it easy for customers to complete their transactions on the go but also improves security by reducing the need to enter their payment information manually.

Personalized payment experience

Print-on-demand businesses are providing personalized payment choices to their customers. This means you can pick from a variety of payment options that suit your needs.

For example, customers who prefer to pay with digital wallets can do so. Also, they have the option to choose traditional methods like cash or cheque.

Moreover, customers may receive special discounts or loyalty rewards with certain payment methods. This improves their overall payment experience.

Subscription models

Some POD businesses are offering subscription models, where customers pay a monthly fee in exchange for a set number of products or discounts on future purchases. This strategic approach provides a predictable revenue stream for businesses and has the potential to increase customer loyalty through attractive perks.

For example, Threadless, marketplace, offers a subscription service known as Threadless Select. With Threadless Select, customers pay a monthly fee and receive discounts on future purchases. This subscription model provides a steady income for Threadless and also encourages repeat business from customers.

Cryptocurrency payments

Some print-on-demand merchants are starting to accept payments in cryptocurrencies, such as Bitcoin or Ethereum. This payment method offers a high level of security and privacy and can attract tech-savvy customers who prefer to use cryptocurrencies.

For example, the print-on-demand platform Redbubble has partnered with BitPay to accept payments in Bitcoin. This allows customers to pay for their orders using their cryptocurrency wallet without having to go through a payment gateway.

Multi-currency pricing

Print-on-demand businesses that operate in multiple countries may offer multi-currency pricing, allowing customers to view the cost of their order in their local currency.

This approach can make the payment process more transparent and convenient for customers and can increase sales for businesses.

For example, Printify offers multi-currency pricing for AUD, CAD, EUR, GBP, and USD. This makes it easy for customers around the world to purchase custom products.

Social media payment options

POD companies may start integrating social media payment options, such as Meta Pay (Facebook Pay) or Instagram Checkout, into their payment collection process.

This allows customers to complete their transactions directly on social media platforms without having to leave the app. As a result, users enjoy a smooth and integrated purchasing experience, which improves both convenience and accessibility.

For example, the leading e-commerce platform Shopify has integrated with Meta Pay, allowing customers to pay for their orders directly through Facebook.

Payment Collection in Print-on-Demand Businesses: How it Will Look Like in the Future

Whether you are looking at how to start an Etsy shop or any other POD service, you will have to deal with the evolving payment collection process. As technology continues to advance and consumer preferences evolve, this important process is likely to undergo significant changes in the future. Moreover, businesses need to proactively adapt to these shifts to remain competitive and meet the ever-changing demands of the market.

Here, we’ll explore some predictions for how payment collection in POD businesses may look in the years to come.

Increased use of cryptocurrency

As more people become familiar with cryptocurrency, print-on-demand businesses may start accepting it as a form of payment. Cryptocurrency transactions are secure and can be completed quickly. This could appeal to customers who value privacy and convenience.

For example, Teespring, a prominent POD platform, announced that it will start accepting cryptocurrency payments through BitPay. This move allows Teespring to tap into a growing market of cryptocurrency users and provide a more convenient payment option for its customers. This forward-thinking initiative broadens Teespring’s market reach and also improves customer convenience with a payment alternative.

One-click payments

Print-on-demand companies may adopt one-click payments, which allow customers to complete their transactions with just one click. One-click payments are fast and convenient, which could lead to higher conversion rates.

Amazon offers one-click payments, and this sole feature has helped the platform to grow over the years. It allows customers to complete their transactions quickly and easily. Print-on-demand businesses may adopt similar one-click payment options in the future, particularly as more customers shop on their mobile devices.

Custom payment plans

If platforms offer custom payment plans for their products, customers can choose to pay in installments over a set period of time. These payment plans often start at 0% interest rates or whichever suits them best. This allows customers to buy more expensive products with less financial strain. As a result, this expands customer purchasing capabilities.

Improved fraud detection

Payment gateways may start implementing more advanced fraud detection algorithms to prevent fraudulent transactions. This could reduce the number of chargebacks and increase customer trust in print-on-demand businesses.

For example, SoFi, PayPal, and Stripe already use machine learning algorithms to detect and prevent fraudulent transactions, and these platforms often publish detailed credit card fraud reports to help businesses understand and mitigate such risks. As POD continues to grow in popularity, payment gateways may implement more advanced fraud detection algorithms, real-time transaction monitoring, and leverage the power of artificial intelligence to protect both the business owner and the customer.

AI-driven personalized payment recommendations

The AI can make personalized payment recommendations based on customer behavior and purchase history. Also, it can suggest payment options based on customer preferences.

For example, an AI system could suggest a mix of one-time payments and installment plans to fit the customer’s budget.

Moreover, AI can dynamically adjust these recommendations in real time based on market trends and shifts in customer behavior.

For instance, if the AI detects a customer showing interest in a specific print but hesitating due to pricing, it may instantly propose a limited-time discount or a custom payment plan to encourage an immediate purchase. This not only increases the chance of a sale but also makes customers feel personally attended to.

Increased use of biometric authentication

Biometric authentication, such as fingerprint or facial recognition, is becoming more popular as a secure and convenient method of payment authorization. POD businesses may start adopting biometric authentication to verify customers’ identities and authorize payments. This would reduce the risk of fraud and provide a smoother payment experience.

Major wallets like Apple Pay and Samsung Pay already use biometric authentication for mobile payments, and more payment gateways may adopt this technology in the future.

Integration with virtual and augmented reality

As virtual and augmented reality technology continues to advance, print-on-demand businesses may start integrating it into their payment collection process.

Customers could use virtual reality to see how their customized products will look before making a payment. Similarly, augmented reality enables visualizing the products in their intended home environment. This technology provides a more immersive shopping journey. So, this could improve the customer experience and increase engagement.

Increased emphasis on sustainability

As consumers become more aware of the impact of their purchasing decisions on the environment, print-on-demand businesses may start incorporating sustainability into their payment collection process.

Businesses can incentivize environmentally conscious practices by offering discounts to customers who opt for sustainable payment methods. It could include payment methods such as cryptocurrency or electronic payments.

Another great approach is to allocate a portion of profits towards supporting environmental causes. Not only does this attract eco-minded customers but it also contributes significantly to improving the brand’s reputation as a socially responsible entity.

This dual strategy aligns financial transactions with environmental responsibility. It creates a positive image for the business and also promotes sustainable choices among consumers.

Conclusion

Payment collection, alongside various print-on-demand services, is a critical aspect of running a print-on-demand business. While the current payment collection process relies on payment gateways, there are many trends and predictions that could shape the future of payment collection in print-on-demand businesses.

Integrations with e-commerce platforms, mobile payment options, and subscription models are just a few examples of the direction that it could take. By staying up to date on these trends and predictions, print-on-demand business owners can ensure that their payment collection process is secure, efficient, and convenient for their customers.

We also have a comprehensive guide, full of strategies to start a business that is unique with a strong brand identity. It outlines various tips, effective strategies, and plans to incorporate that can set a solid foundation for business success.